Budweiser Brewing Group (BBG) is in a pretty good place right now – and that’s largely down to the fact the on-trade is being allowed to function without restrictions and people have flocked back to UK pubs.

BBG UK & Ireland on-trade director Jean-David Thumelaire – better known as simply JD – says the UK on-trade has recovered quicker than all other markets in Europe once allowed to reopen from pandemic closures and restrictions, and the business is targeting the pub sector after securing some 10% of the market share last year, which proved to be a record year since 2013 (30% in the off-trade).

“It’s very obvious that the on-trade is a massive opportunity for us to focus on,” JD says. “It’s an important ‘bet’ for us. Worldwide, we’re the number one brewer with 30% share. Although it’s difficult to quantify market by market, the UK is one of our top markets and is in the top 15 markets in the world.

“In some countries, for example in Belgium, where I’m from, it’s approximately 50% and then in South Africa it’s about 80% with some others at 90%.”

The Belgian began his career with AB InBev, which is the parent company of BBG UK&I, more than 12 years ago as a trainee that led to him working at the Magor brewery in Wales and in Brussels before moving on to Johannesburg after the integration of the SAB Miller group. He moved back to Europe about a year and half ago.

BBG, which is one of the four largest brewers in the UK alongside Heineken, Molson Coors and Carlsberg Marston’s Brewing Company, employs about 1,000 people in the UK and has three big breweries in Magor in south Wales, Samlesbury in Lancashire and Enfield in north London, plus the original Camden Town brewery in Kentish Town, London.

Statistics from CGA brand Index 29.01.21 show it is performing better than its main rivals in terms of growth in 2021 versus 2020, with volume and market share up 48.2% against the average rise of 40% in the industry.

Pub culture is part of people’s lives

Being from Europe, in particular Belgium, JD has always had an affinity with beer but he says the UK pub is something different to everywhere else. He explains: “I’m quite impressed by the UK on-trade industry. I'm from Belgium, where beer is also part of our culture and bars as well but here [in the UK], it's truly impressive to see pub culture is really part of people’s lives and their identity.

“It was super impressive to see the recovery post-Covid. The UK on-trade industry recovered much faster than all the other markets in Europe where we operate right from lockdowns and it was the first one to reopen at scale. You can see consumption rising and occupancy at pubs going up. You can clearly see there’s this emotional attachment from the Brits to the pub, which is awesome to see – it’s where people build experiences, have emotions and make memories.”

JD looks cites the numbers: a workforce of 900,000 in brewing and pubs that creates £23bn. And says this massive part of the economy “has had a very tough time in the past two years” and comes back to BBG’s ‘bets’. “We’ve made a bet on the on-trade,” he says. “Even though it was a tough time, if you look at the past 10 years, it’s true that volume has been tough and has been declining but what you also see is that value is going up – and that’s key.

“People are spending more in the trade and you can see the premiumisation journey that is driving the value trend, and that works perfectly with our portfolio of brands. We really believe there’s a synergy there to be to be made together with our customers. And that’s why we have a very big focus and have made investments in the past two years on the on-trade.”

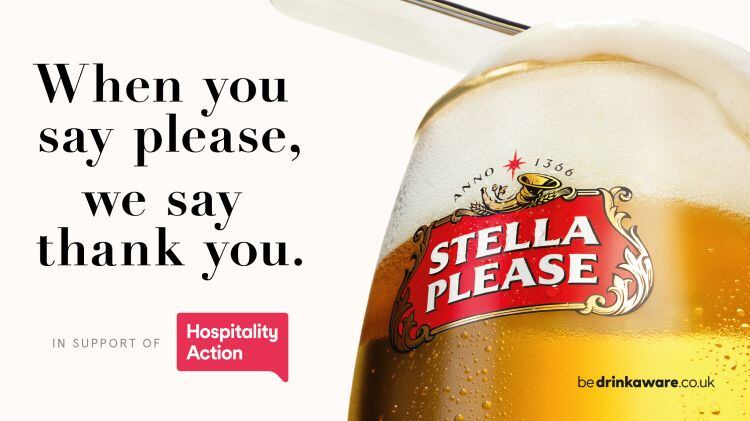

BBG is also launching a new campaign called Stella Please from Monday 4 April. Designed to stop people being rude, whenever anyone orders a pint of Stella and says ‘please’ afterwards, 10p will be donated to Hospitality Action, which helps workers in the sector on a variety of issues including physical illness or mental health issues to financial difficulty, family problems to addiction.

Following on the heels of the 2021 campaign Stella Tips that raised £500,000 for sector staff whenever a Stella was purchased and 2020’s Save Pub Life that allowed customers to buy giftcards when the on-trade was closed for business under the Government’s Covid rules, Stella Please can be used by any pub that signs up to participate.

JD says: “What we see is that as people are coming back to the pubs, they are being more rude than before to bar staff and it’s something we want to change. It’s very simple in we’re asking the nation to say ‘please’ when they buy a Stella, or a beer in general. For every Stella bought when the consumer says ‘please’, we will donate 10p to Hospitality Action. We’re planning to raise at least £150,000 that will go to bar staff who have had a very tough time during the past two years.”

Stella Please strives to address poor consumer manners and drive positive sentiment towards the sector’s employees with its main function being to empower hospitality staff and let them know they are supported, and they can get support from Hospitality Action, when needed.

Premiumisation is the word

BBG splits its beers into categories and has seen a definite trend of customers choosing premium options meaning they will spend more at the bar.

“Premiumisation is the main thing happening – and that’s not just for beer, it’s across the on-trade in general,” explains JD. “What you’ve seen is for the past 10 years, premiumisation has been happening but last year, for the very first time, premium/super premium volumes were bigger than mainstream core lager.

“Core lagers would include Foster’s, Carling and Carlsberg, whereas premium would be Budweiser, Stella Artois and above in terms of price point. Premium has had more demand in the off-trade but this is the first time ever in the on-trade. You can clearly see the consumer shifting. We’re talking 41% of the volume being produced is premium, and translated to value of spend is even higher so that’s why we’re focusing on that.

“Premium is growing for sure but it is not the main growth driver. The main growth is coming from the level even above that, which is super premium. And within super premium is world lager – all your international premium lagers – and speciality beers.”

Within the world lager category are BBG brands such as Corona and Mahou and its main speciality beer is Belgian favourite Leffe. Craft is also in growth according to JD and Camden Pale Ale and Camden Hells are two of the brands stand-out contenders in the division.

On its brand, JD says: “Stella is probably our flagship beer and that’s why we use it for supporting the industry but we also launched Corona on draught within the past two years. We have Budweiser obviously, Bud Light, Camden, which is now completely integrated into the BBG business now.

“There’s Leffe, which is the number one speciality beer brand in Europe and we’ve recently acquired distribution rights for Mahou, which is the number one beer brand in Spain so we have a partnership there with Mahou San Miguel. And we have Goose Island and we’re very proud to have heritage brands like Bass and Boddingtons, which are local champions in our portfolio.”

Demands for its beers are more than encouraging. JD says brands such as Corona, Stella and Budweiser are in the top 10 of the largest and most popular beer brands in the world and are in the top five in the UK, in terms of demand.

“In terms of market share, we’re at 10% in the on-trade but demand is actually higher than that,” says JD. “There real consumer demand for our brands. It’s approximately double our market share, which is great news for us to see consumers actually want our brands.”

“This gives us a lot of confidence and we actually see a consumer demand for a portfolio that is higher than 2019 levels already and that’s very, very encouraging.”

Deal struck with JDW

BBG struck a 20-year supply partnership with JD Wetherspoon late last year that effectively ended Heineken’s 41-year association with the manged pub giant.

“We were delighted about the deal and strengthen our partnership with JD Wetherspoon, which was already a long-standing relationship. It was a lot of work from both parties and we’re very thankful for that from their side as well.

“The rationale behind it is that premiumisation trend again, which [JDW] recognised as well as being something they want to bet on. If you see the range they're going towards in their draught portfolio, it’s much more premium. You will have the likes of Corona and Leffe nationally available on draught.

“That was really the rationale for them to make a switch and look at which brands could be the best to take that opportunity. This requires also a lot of investment, which we’ve made in our supply chain and right across the board to make sure we could sustain this demand plus, of course, the already strong demand we saw outside of this deal.”

He adds 2022 is going to be the biggest year of investments for BBG in the on-trade. In a bid to be “the most trusted partner for our customers”, BBG’s investments include £115m in its UK breweries to extend capacity to cater for larger demands.

There has been money spent on hundreds of thousands of kegs; in its trucks, which has created 55 new jobs; and taking its drinks dispense capabilities in house, which has provided jobs for 100 more people and involves engineers dealing with draught equipment at on-trade sites.

JD says its investment in putting Corona on draught was a decision made easy by the fact 95% of on-trade consumption is through draught and BBG was missing out on vital revenue. The Corona draught launch took place in the UK before other world markets and has been “a big success” despite being a big investment as proved by an Advantage survey that placed BBG as one of the top beer suppliers in the on-trade last year.

Craft brand Camden Town Brewery, which BBG acquired in 2015, has been a “massive success” the on-trade director says and believes the brand has even more potential.

“The UK beer market is amazing. It’s very fragmented with a lot of choice. There’s not a lot of British brands funnily enough if you compare it to other countries. It’s very international and has great beer but it lacks a premium British beer that can grow and become nationwide. Camden has that potential – it’s a beautiful beer.

“We were the shareholders of the business for the past 10 years but it was run as a separate business. In January 2021, we completely integrated the businesses, which is easier for us in terms of working together with our partners with our customers. It’s going extremely well. Last year, Corona draught was our number one contributor to growth rate in the on-trade while Camden was number two.

“It was launched as a London brand, of course, and now you can clearly see the demand expanding to the rest of the country. Now Mahou is an exciting one as well. It’s the largest beer brand in Spain and since July last year, we have had the distribution rights, which were with Carlsberg Marston’s before.”

All-time-high market high

On BBG’s performance in the past year, JD explains the business’s notion of making bets on the on-trade paid off quickly as the country emerged from the restrictions enforced by the pandemic.

“We actually had a very strong year, achieving our all-time-high market share since 2013,” JD says. “The bets and investment that we made and the belief we have in the channel can be clearly seen in the demand coming through, which is quite exciting.”

Looking to the future and how to continue to focus its sights on the on-trade, JD explains: “Number one is the continuation of all the trends mentioned. We can see consumer confidence coming back to the on-trade, we can see the channel is resilient and that premiumisation is happening. It’s going to be a strong year and the first full one since Covid.

“We have something big this year, which is a football World Cup so that should be interesting. Consumers spend more right and coming to the on-trade more when a World Cup is on. A World Cup drives approximately 39% of incremental spend so that is quite exciting for pubs and we are the official sponsor of the World Cup and also the England team with Budweiser and Bud Light. It’s very exciting and we are preparing for that moment because it’s in winter this year for the first time.

“So when you combine it with Christmas in the UK, which already gives a big jump in consumption, it’s going to be an exciting moment for the pub industry and probably the big highlight of the year. We have also signed a deal with BT Sport during Covid.

“We have plans also in terms of innovations. We are launching Stella Artois Unfiltered, which we're very excited about and have had some very positive first results. We’re launching it on bottle on 9 April and then on draught during the summer and another one is Corona Cero, which is the non-alcoholic version of Corona, which is set to launch this week.”

Another move by BBG is the launch of Ukraine beer brand Chernigivske to the on and off-trade with all profits being donated to support humanitarian relief efforts in the war-torn country, which includes a guaranteed $5m from parent business AB InBev.

One can only hope to see improvements in Ukraine as have taken place in the UK on-trade.